Industris Services

BROCHURES

Download your Free Report: What every business owner must know

Download Brochures PDFGET A QUOTE

OVERVIEW

What you need to know

The renewable-energy industry is the part of the energy industry focusing on new and appropriate renewable energy technologies. Investors worldwide have paid greater attention to this emerging industry in recent years. In many cases, this has translated into rapid renewable energy commercialization and considerable industry expansion. The wind power and solar photovoltaics (PV) industries provide good examples of this.

Renewable energy industries expanded during most of 2008, with large increases in manufacturing capacity, diversification of manufacturing locations, and shifts in leadership.[2] By August 2008, there were at least 160 publicly traded renewable energy companies with a market capitalization greater than $100 million. The number of companies in this category has expanded from around 60 in 2005.

Some $150 billion was invested in renewable energy globally in 2009, including new capacity (asset finance and projects) and biofuels refineries. This is more than double the 2006 investment figure of $63 billion. Almost all of the increase was due to greater investment in wind power, solar PV, and biofuels.[4]: 27

In 2000, venture capital (VC) investment in renewable energy was about 1% of total VC investment. In 2007 that figure was closer to 10%, with solar power alone making up about 3% of the entire Venture Capital asset class of ~$33B. More than 60 start-ups have been funded by VCs in the last three years.[5] Venture capital and private equity investments in renewable energy companies increased by 167 percent in 2006, according to investment analysts at New Energy Finance Limited.[6]

New investment into the sector jumped US$148 billion in 2007, up 60 per cent over 2006, noted a report by the Sustainable Energy Finance Initiative (SEFI). Wind energy attracted one-third of the new capital and solar one-fifth. But interest in solar is growing rapidly on the back of major technological advances which saw solar investment increase 254 per cent.[7] The IEA predicts US$20 trillion will be invested into alternative energy projects over the next 22 years.[7]

- Construction of hydroelectric reservoirs

- Installation of equipment and exploitation of wind energy

- Installation of equipment and exploitation of solar energy

- Manufacturing and manufacturing generators

FEATURED

Why Choose Us?

Dedicated Team

True Partners

Global Know-How

Focus On Innovation

RELATED PROJECT

Projects in the field

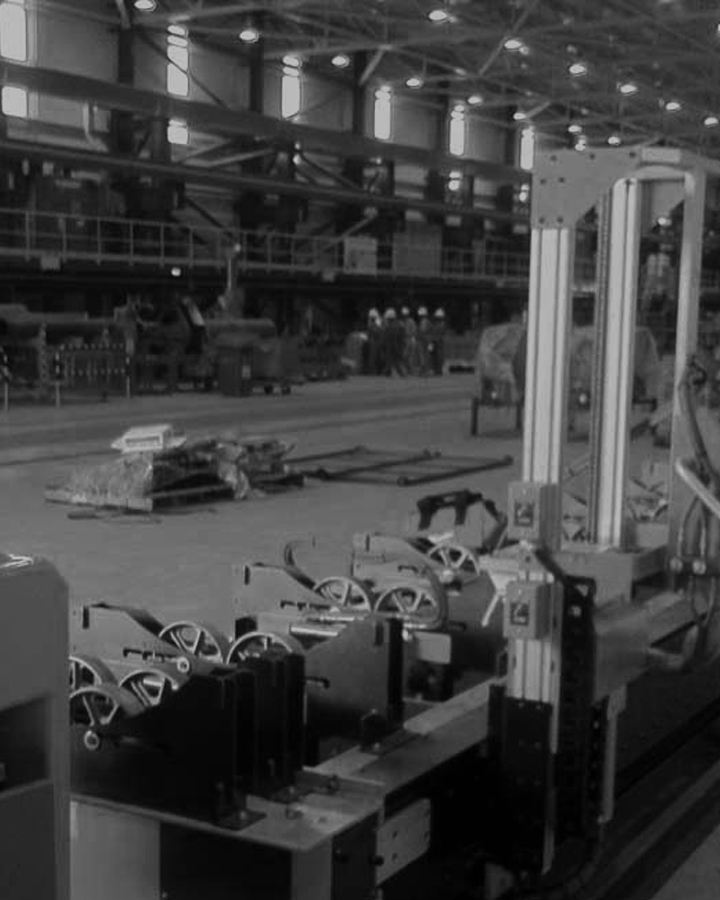

N-KOM Qatar

In 2007, Qatar Gas Transport Company (Nakilat) entered into a joint venture with Keppel Offshore & Marine (KOM) with the vision to establish a world-class shipyard in Qatar. Three years later, the

View details